A GLIMPSE OF THE REAL ESTATE BUSINESS IN TODAY’S PRIME MARKET

May 2025-Barcelona, Spain.

A GLIMPSE OF THE REAL ESTATE BUSINESS IN TODAY’S PRIME MARKET

Understanding the real estate sector in all its dimensions is a very complex task. The real estate industry, especially in urban proximity & with various types of hyper-efficient storage solutions, commercial (offices), retail (retailer), hotel, residential, with mini-sector spots (that share professional or cultural interests, such as technology managers or athletes) & branded residences in major & secondary cities, coastal or rural destinations, and why not, funds & investment managers, and family offices, which are betting on unique assets.

Yet in 2023, data collected by Knight Frank in its annual report The Wealth Report, showed that the Spanish high-end (prime) residential real estate market in prime locations was going through its best period with a very high percentage of property transactions already coming strongly from 2022. Today, according to all the news & a report prepared by Grupo Tecnitasa, it is confirmed that this niche market maintains & continues to grow strongly, as are prices. In this operations emerging trend, the first order destinations that are referents of this market, without a doubt & in terms of profitability, are Madrid, Malaga with Marbella at the head with a change of legislation & tax application, Balearic Islands, Alicante (booming) & Barcelona.

But who buys these assets, which become an investment strategy with a high added value? The profile of the most widespread buyer has a high purchasing power, is usually demanding & values privacy, services & location. They are:

– executives over 40 years old, single or with family;

– Millennials (those born between the early 1980s & early 2000s, who are hyper-connected digital natives);

– Generation Z (or Centennials, those born between the mid-1990s & early 2010s);

– the international investor, who calculates a safe return & increases their capital in the short, medium & long term.

For more information on prices & price increases in high-end/prime housing, see Knight Frank’s Prime International Residential Index (PIRI 100).

The labor market’s appetite for the use of spaces that challenge the ability to adapt is consolidating & becoming a trend. And it is at this turning point that the corporate real estate field also comes into play, which is laying the groundwork for an eloquent transformation in the coming years. In other words, all companies (especially the micro ones) that strategically invest in technology, AI & data to enhance the work of the agents who manage their real estate portfolio, and that support & encourage flexibility so that the entire process ends in harmonious & sustained growth over time, will emerge as champions in this new structure of real estate sphere.

In Spain, invariably, there are urban & coastal areas that are always more attractive than others for domestic & foreign investors, as I have pointed out before; so positioning a property properly will be the main letter of introduction. Perhaps I am wrong, but in this post-hybrid era in which global challenges marked by the health crisis & financial tensions arising from geopolitical & economic turbulence are bruising this last five-year period, experts argue that in the global economy growth forecasts are being cut due to increased economic uncertainty & the greater likelihood of a global recession. In this kind of market, I don’t see it.

Despite this cautious environment, interest in buying & selling properties in our country gained strength throughout 2024 & continues to do so so far this year. Today, we see that there is intense economic activity in the prime housing sector. And anyone with a solid balance sheet who is actively looking for an expansion opportunity, it shows up & it matches because there are significant waves of collaborations, mergers & acquisitions; this path is transforming our competitive skyline. This is the case, for example, of hotel investment in smaller-scale properties that stand out for their authenticity. In its calendar are the transformation of emblematic assets into boutique hotels & are leading it towards a professional management model that goes hand in hand with recognized (hotel) brands that are part of others. Lifestyle is the concept that prevails & they benefit from the financial backing of private investors (national & international).

From TREC Barcelona & our experience, we must not forget that whether for rehabilitation, hotel, renovation or new construction, the hyper bureaucratization of any process with the technical services of the municipalities in Catalonia hinders the economy, as well as the rampant taxes.

Do you have ambition to make an impact? Are you a strategic buyer? If you are considering investing, contact us. We will be happy to guide you & suggest some real estate experiences.

A full scope of services, our team give practical, concrete & expert answers to our customer’s demands.

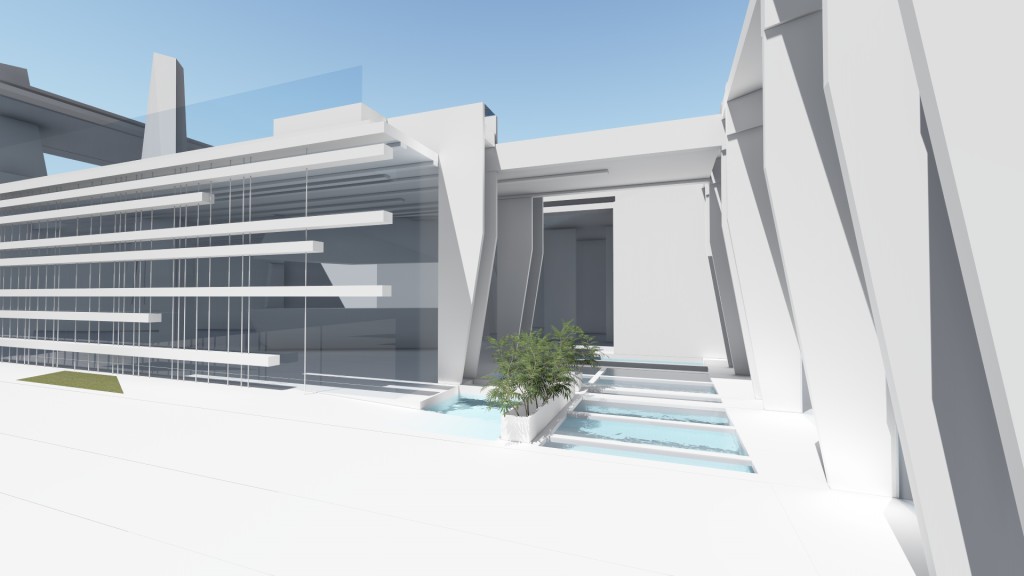

At TREC Barcelona, remodeling historic buildings with the necessary mastery to combine stately architecture with contemporary styling while maintaining the elements that form part of their history is one of the jobs we love the most.

Specializing in recovering assets that enhance their authenticity & identity, our main recipe is to master the heritage and, for this & high-level buyers & investors, knowledge is a priority.

Investment & Asset Management, Housing, Interior & Refurbishments, Customized, Sustainable Architecture

Public relations with creative vision & savvy marketing.

DARE TO BE UNIQUE.

All rights reserved. TREC Barcelona & Associates 2025.